Self funded insurance can be a game-changer for employee healthcare. Imagine cost savings and a custom plan – exciting! But there’s a catch: regulations.

Think of self funded plans as a powerful engine. It can revolutionize your healthcare approach, but just like any powerful tool, it needs careful handling and knowledge of the safety rules. The world of regulations can feel like a maze. Don’t worry, this guide will equip you with the essentials.

ERISA: The Champion of Self-Funded Plans

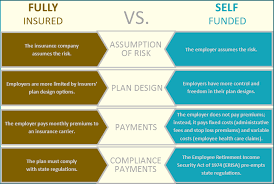

Unlike traditional plans with insurance companies as financial buffers, self-funded plans place the responsibility squarely on your company’s shoulders. This shift necessitates a different rulebook, and that’s where ERISA, the Employee Retirement Income Security Act, comes in. This federal law acts as the champion of self-funded plans, offering a sigh of relief for multi-state employers. Think of it as a universal rulebook that simplifies compliance compared to the patchwork of state regulations.

Compliance Requirements: Key Legal Considerations

Self funded insurance offers flexibility and savings, but legal hurdles can trip you up. Here’s your survival guide:

- ERISA: Clear communication about your plan (features, funding, eligibility) is key. ERISA appoints watchdogs (fiduciaries) to protect your employees’ financial health.

- ACA: The Affordable Care Act mandates coverage for essential health benefits, including preventive services with no employee cost-sharing, promoting a healthier workforce.

- HIPAA: This shield protects your employees’ sensitive health information.

- MHPAEA: Levels the mental health playing field by requiring equal access to mental health and substance abuse benefits compared to medical care.

- COBRA: A safety net for job loss or reduced hours, COBRA allows qualified individuals to continue health coverage for a limited time.

ERISA Regulations

“ERISA” might sound like legalese, but for self funded plans, it’s a crucial shield. This federal law sets minimum standards for employee plans, offering basic protections. But ERISA’s power goes beyond safeguards. It simplifies life for employers by creating a uniform rulebook across states, eliminating state-by-state headaches. Here’s how ERISA shapes self-funded plans:

- Clear Maps for Participants: ERISA mandates a Summary Plan Description (SPD) – a user-friendly guide outlining features, eligibility, and benefits.

- Guardians of Financial Well-Being: With self-funded plans, your company shoulders healthcare costs. ERISA recognizes this with “fiduciary duty.” Plan sponsors become responsible stewards, managing assets prudently and prioritizing participant well-being.

- Lifting the Veil on Finances: ERISA empowers participants with knowledge. Annual reports to the Department of Labor provide a window into the plan’s financial health, fostering trust through transparency.

- The Right to Challenge Decisions: Life can be unpredictable, and claims get denied. ERISA ensures a fair and timely process for handling appeals.

Updates in the Regulatory Landscape

Self funded plans offers flexibility, but regulations can shift like stormy seas. Here’s how to stay on course:

- ACA Updates: The Affordable Care Act (ACA) is your ever-changing map. Stay informed about new enforcement and coverage rules.

- Mental Health Parity Gains Ground: The fight for equal mental health coverage is winning. Expect stricter enforcement of equal benefits for mental and physical health.

- Data Security: Build a Fortress: Data breaches are a rising tide. Invest in secure electronic records and clear protocols to protect your employees’ health data with HIPAA as your shield.

Wrapping It All Up

Self funded plans offers flexibility, but navigating its legal landscape can feel like scaling a sheer cliff face. Here’s how to reach the summit:

- Stay Informed: Regularly check with the DOL, IRS, and HHS for regulatory updates.

- Seek Expert Guidance: Partner with legal and compliance experts – your trusted sherpas on this legal trek. They’ll decipher legalese and guide you through necessary changes.

- Document Everything: Maintain detailed and accurate plan documents – your roadmap – updated to reflect any legal shifts.

By following these best practices, you can navigate the legal complexities of self funded plans with confidence. With the right preparation, you can turn the legal terrain into a path towards a secure and successful healthcare plan.